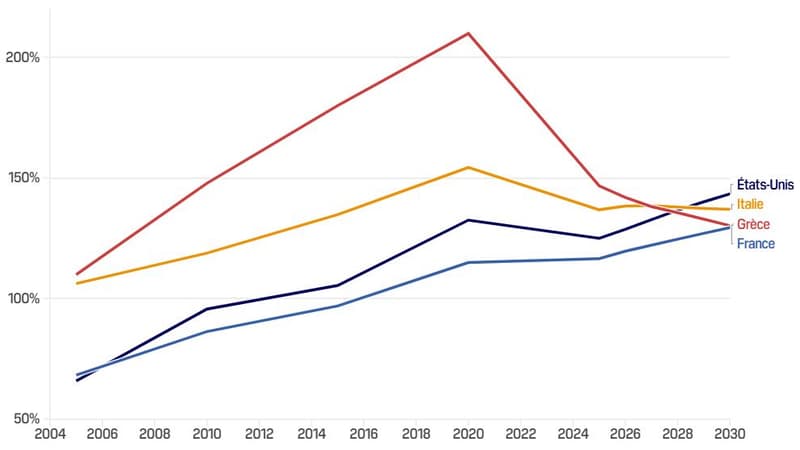

A new threshold was crossed. A few days ago, the US public debt exceeded $38 billion, which represents 125% of GDP, that is, 20 points more than ten years ago. And the headlong race is likely to continue for a long time, according to the latest IMF forecasts.

According to the international institution, the United States debt, which is already the highest in the world in terms of value, is expected to increase almost 20 points by the end of the decade, reaching more than 143% of GDP in 2030. A ratio that would then be higher than that of Italy or Greece, countries that have long been mocked, even on the other side of the Atlantic, for their lack of budgetary seriousness.

Greece and Italy settle their accounts

But in recent years, Athens and Rome have managed to regain control of their public finances by reducing their deficits. As a result, after peaking at 210% of GDP in 2020, Greek debt today represents 146% of national wealth and would be 130% in 2030, the same level as in France, again according to the IMF. For its part, Italy has also seen its debt gradually reduced, going from 154% of GDP in 2020 to 137% currently. A level that would remain more or less stable until 2030.

This crossing of curves between the American, Greek and Italian debts is “a symbolic moment,” says Mahmood Pradhan, head of global macroeconomics at the Amundi Investment Institute, in the Financial Times, highlighting the “perpetual deficits” of the United States.

In fact, the budget deficit should remain above 7% in the coming years on the other side of the Atlantic, the highest level observed among rich countries. Among the causes: Donald Trump’s “great and beautiful law” adopted in July and which provides, in particular, for the perpetuation of massive tax cuts. According to the Congressional Budget Office (CBO), the text alone is expected to increase the debt level by about $2.4 trillion by 2034.

The privilege of the dollar

In the longer term, the CBO predicts that US debt will reach 145% of GDP in 2050. The US Treasury’s forecasts presented at the beginning of the year in its annual report are even more alarming, since they foresee an increase to 200% in 2050 and even up to 535% of GDP at the end of the century if the current rate of change in public spending is maintained.

“Many American politicians and investors tend to belittle Europe, with its weak growth and struggling economies, but when we look at those indicators, the discourse changes,” says James Knightley, US economist at ING, in the Financial Times.

Let us remember, however, that the United States has a much greater debt capacity than European countries, particularly thanks to the “exorbitant privilege” of the dollar. A dominance of the dollar that allows the American federal government to borrow massively in the markets at an affordable cost. Growth forecasts for the United States are also more favorable than those of some European countries such as Italy, which suffers from an aging population and a particularly low level of productivity.

However, America’s runaway debt is not without consequences. The Moody’s agency issued a warning in May by withdrawing its “triple A” rating in the United States. U.S. bond yields have also risen in recent months, a sign of increased investor concern. And the long-lasting paralysis of the US administration due to the lack of agreement on the budget should not help matters in the short term.

Source: BFM TV