China’s exports slowed down more strongly than expected in May, official statistics revealed on Monday, sending goods to the United States falling under Donald Trump’s commercial war. According to Chinese customs, exports only increased 4.8% for one year last month. A much lower result than the forecasts of economists interviewed by the Bloomberg agency, which domesticated +6.0%.

Another disappointing figure announced Monday by China: consumer prices in the country fell in May for the fourth consecutive month. The particular consequence of the low domestic expense. Since the end of the Covid-19 pandemic, the Asian giant has faced deflationary pressure, particularly due to a crisis in the real estate sector and the high unemployment among young people. China is struggling to revive consumption, which threatens its growth and complicates its efforts to protect its economy from the customs rights campaign of US President Donald Trump.

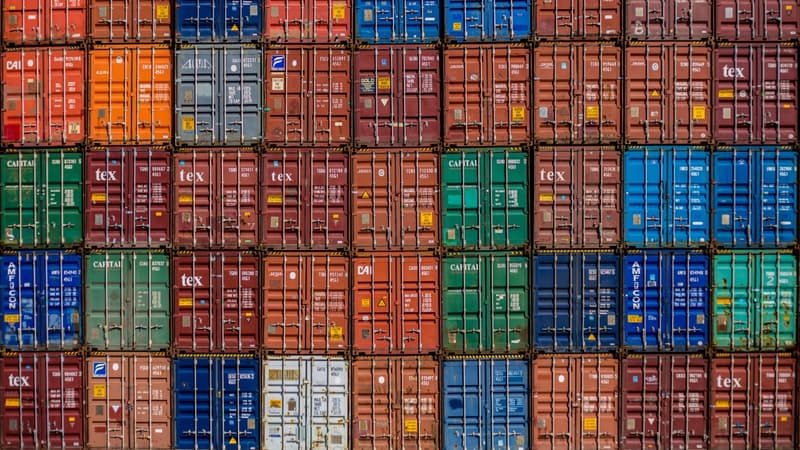

After Geneva last month, the Americans and the Chinese began a new series of discussions in London on Monday, with the aim of extending their commercial truce and perhaps finding a lasting agreement on the reduction of customs surcharges they earn. Because these surcharges seem to have concrete effects on exchanges. Chinese exports to the United States amounted to $ 28.8 billion (25.2 billion euros) in May, compared to $ 33 billion (28.9 billion euros) in April, according to Chinese customs. This is a 12.7% drop for a month.

“Very uncertain”

At the same time, exports to Vietnam increased slightly in May to reach $ 17.3 billion. “The commercial war between China and the United States has led to a strong drop in exports to the United States, but this fall was compensated by an increase in exports to other countries,” Zhiwei Zhang wrote, economist for precipitated asset management.

“Commercial prospects are still very uncertain at this stage” and problems “may arise, since the effect of anticipation is fading,” says Zhiwei Zhang, referring to foreign buyers who had increased their requests for Chinese products in anticipation of possible increases in US surcharge. Chinese imports fell 3.4% in May, reflecting the slow demand and increased commercial pressures on the economy of the second world.

For its part, the Consumer Price Index (ICC), a key measure of inflation, fell 0.1% in May for more than a year, in the same proportions as the previous month, the National Statistics Office (End) announced on Monday. Economists interviewed by Bloomberg had anticipated a more marked fall (-0.2%). Therefore, China remains in a deflation period. If deflation implies a drop in goods prices, it also represents a threat to the economy, because consumers tend to postpone their purchases, with the hope of new reductions. This lack of demand can force companies to reduce their production, freeze hiring or rule out.

Call with Trump

Additional signal of persistent problems in the Chinese economy: the production price index, that is, the cost of goods at factories, fell 3.3% for a year in May. This is an accentuation compared to the fall recorded in April (-2.7%). Declive production prices, as observed in recent months, are synonyms for reduced margins for companies.

The discussions but Americans scheduled for Monday in London will mark the second formal negotiations between the two countries since Donald Trump launched his world commercial offensive. On the American side, the delegation will be composed of the secretary of the Treasury, Scott Besent, that of Commerce, Howard Lungick, and the White House representative for Commerce (USTR), Jamieson Greer.

As in Geneva, they will discuss in particular with the Vice Primer Chinese Minister, he LIFENG. These discussions take place after a telephone exchange Thursday between Donald Trump and his Chinese counterpart Xi Jinping, a conversation qualified as “very positive” by the US president.

Source: BFM TV