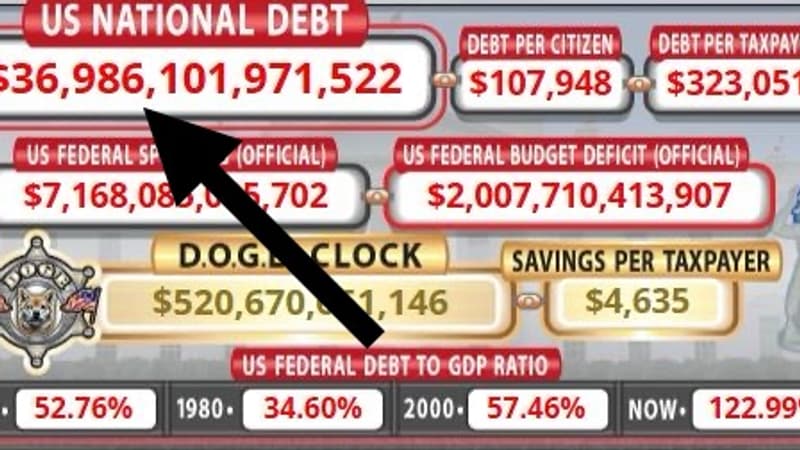

A new level that runs the risk of strengthening investors’ concerns. And probably those of Elon Musk who had not hesitated to alert in February about the risk of “bankruptcy” of the United States. Already established in 122% of GDP, the US debt that has almost doubled in ten years is preparing to cross the threshold of 37,000 billion dollars, thus consolidating its innatiable state of a largest world debt in absolute value, according to the countdown account made by the national debt clock of the US site.

If the state of US public finances has been ignored for a long time, markets seem less and less inclined to close their eyes. Because the policy led by Donald Trump has only accentuated fears on the inability of the United States to reduce its abyssal deficit (6.4% of GDP in 2024) and master the trajectory of its public debt.

The interests of the explosive debt

The budget of “Grande and Beautiful Law” of the White House tenant is particularly concerned. The text must allow you to materialize certain badges of your campaign, in the first place, the extension of the gigantic fiscal credits of your first mandate. However, the adoption of this law could lead to an increase in the US deficit of $ 2,400 billion in the next ten years according to the Congress Budget Office.

Given the emotion of American debt, the Moody’s agency launched a warning in May by eliminating its maximum AAA note for the first time in the United States to demonstrate it to AA1. For their part, bond rates in 10 and 30 have jumped in recent months. A sign that American treasure invoices no longer attract as much as before.

As a result, interest on debt is also flying. They reached $ 92 billion in the month of May alone, which represents 65% of the Income Tax paid by the Americans during this month, according to the Treasury figures. Throughout the year, interest payment is estimated at more than $ 1,200 billion, or 40% of income tax revenues. It is also more than the expenditure of the United States in its defense (880 billion).

“There is no discussion about the necessary correction of deficits”

For Moëc Gilles, chief economist of the Axa Group, the weight of US debt in GDP is at a level “that we see regularly in some European countries, but still long for a country that remains the heart of the engine of the economy and global finances.”

But the most worrying “is that we do not see a retirement force. These discussions about the budget in Congress oppose people who seek to go a little further towards the increase in certain expenses for those who seek to go a little more towards the fall in certain recipes. But there is no longer any discussion about the necessary correction of the deficits,” he explains in the BFM company.

Source: BFM TV