As part of our special retirement life, many questions concerned pension contributions related to the apprenticeship period. Between 1973 and 2013, trainees often validated only a small number of terms per year, or even none at all. This unfavorable calculation prevents some of them from benefiting from the device in very long careers, which allows early retirement for workers who have validated at least five quarters before the age of 18 or 20.

An Internet user who began his apprenticeship in October 1980, explains that in that period “he had not contributed quarters” for “too little amount”. “Can I claim the long run?” wonders on her part Chrystèle, 47, recognized as a disabled adult and who “started working at 18” with a year of apprenticeship. A third future retiree wonders: “I started with an apprenticeship at 16 (…) At the end of 2022, I had added 166 quarters. I have a son. How many quarters should I have? When can I retire?”

Learning trimesters taken into account in certain cases

Since the law of January 20, 2014, each apprenticeship quarter is counted as contributed, because “apprentices contribute on their actual salary,” Audrey Mazin-Sindo, retirement project manager at the firm Silver Up, details for BFM Business.

Prior to this date, certain apprentices’ housing was provided by their employer. “But what raises the question are the apprentices who do not have a quarter of their learning that appears on their career sheet: it was the State that was in charge of their contributions at that time, their employers were exempt,” says the expert. “They must request a regularization, an apprenticeship contract as support,” he explains.

Unfavorable calculations for ex-apprentices

However, at that time, “apprentices received a percentage of the Smic, which varies according to age, on which a flat rate calculation was applied,” continues Audrey Mazin-Sindo. Problem: “This lump sum calculation is so low that, at most, a trainee will only validate two quarters per year, instead of the required four quarters.”

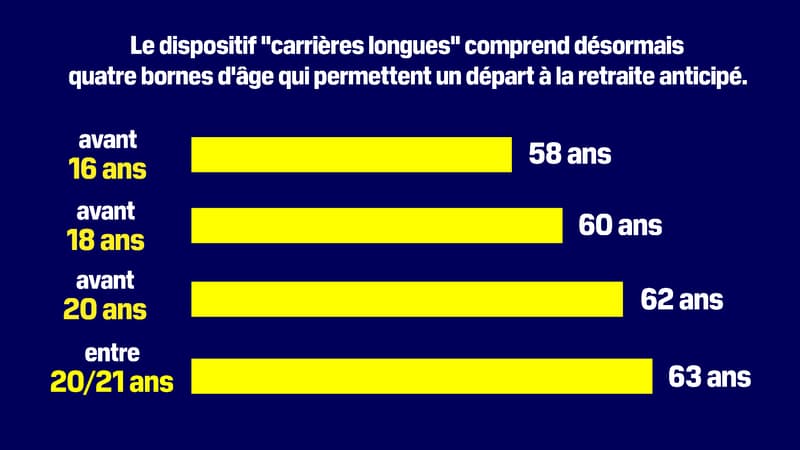

This degraded number of theoretically validated quarters implies that some pre-2014 apprentices do not meet the conditions to benefit from the “long career” scheme. For interested trainees who wish to reduce their discount, “it is possible to buy hindquarters at preferential prices,” Emmanuel Macron said in Parisian in january.

The thorny issue of buy-back learning conditions

The newspaper then reported on the case of Christophe, who had started working at the age of 15 on an apprenticeship preparation course and then as an apprentice in the construction industry from the age of 16 to 18. “I find it incomprehensible, especially since they have been careful not to say it clearly since the announcement of the reform,” protested the 48-year-old man, who had to spend more than 5,856 euros to buy back his four rooms worked as an apprentice to go out to age 60 or earlier, according to the calculations of the Retirement Insurance.

For learning periods completed between July 1, 1972 and December 31, 2013, it will be possible to repurchase up to four periods at a lower cost. These redeemed learning terms will be consider “in the context of an early departure for long careers or as a disabled worker,” as provided in one amendment. It should be noted that if rooms are repurchased less than ten years before the completion of the studies of the future retiree, its price will also be reduced.

But be careful, warn the experts interviewed by BFM Business, if it is currently possible to buy back up to twelve periods of higher education, only four terms maximum can be obtained at lower cost.

Source: BFM TV