Long dedicated to its domestic market, the Chinese auto industry is now also making its mark on the export market.

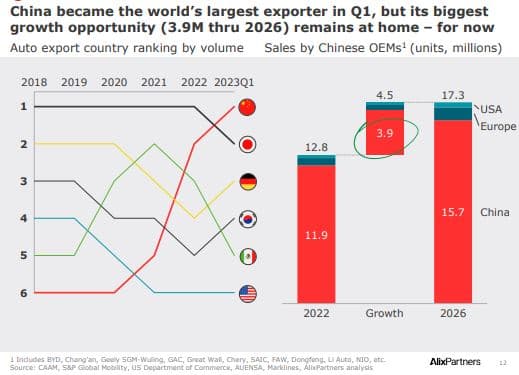

“China, which was the sixth largest automobile exporter before the covid, has dethroned Japan and becomes the new champion of automobile exports in the first quarter of 2023,” underlines the latest annual study of automobiles by AlixPartners.

China, number one in automotive exports

With 1.07 million vehicles exported in the first quarter, we learned at the end of May that China was number one in the world in auto exports, which is confirmed by AlixPartners figures.

First explanation: a “Russia effect,” a market neglected by most other automakers since the invasion of Ukraine. China sold 110,000 cars there in the first quarter of 2023, the same as in 2022.

But there are also my early effects of a rebound in electric car sales around the world, a type of vehicle that China has specialized in for many years.

Of 2.4% of global sales in 2019, electric cars accounted for 13.3% in 2022 and, in its forecasts, AlixPartners anticipates a “zero emissions” share of 34% in 2028 and 61% in 2035.

Chinese brands now dominate at home too

A success outside of the Chinese auto industry, which also doubles as an especially noteworthy event in its home market.

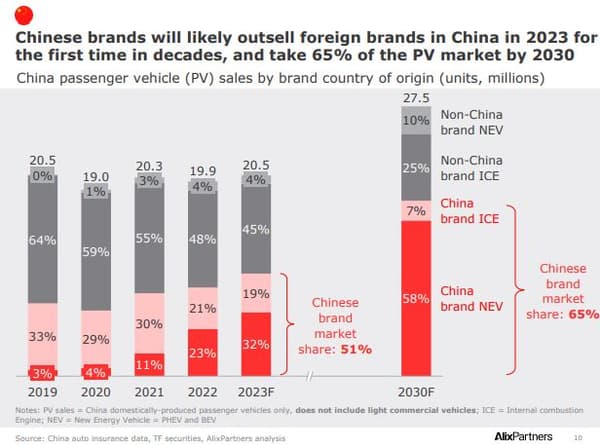

“In the Chinese domestic market, local brands will now surpass foreign brands for the first time in 2023, with a 51% market share, and they are expected to reach 65% by 2030,” highlights the study by the consulting firm Asesoría. .

It is also in this local market where the Chinese automotive industry will continue to grow in the coming years: in 2022, out of 12.8 million units produced, 11.9 million will remain in the country. Four years later, in 2026, AlixPartners forecasts that 86% of the additional 4.5 million units produced will go to its home market.

The move to electric also explains this increase in power: in 2019, non-Chinese brands continued to represent 64% of sales, in a market still highly oriented to thermal.

Three years later, in 2022, we see that while Chinese brands have seen their market share drop from 33% to 21% in thermal, they already weigh 23% in electric. Where foreign manufacturers, especially German ones, have not really managed to get off the ground.

By 2030, AlixPartners estimates that Chinese brands will account for almost two-thirds of car sales in its domestic market, mainly electric.

“Radical choices” behind the success

In order to win customers at home and abroad, Chinese industry has been able to upgrade and stay ahead of this shift to electricity. But Chinese brands have also made “radical choices in product offerings,” the study notes.

“These new players, such as BYD, Xpeng or Zeekr, focus on the aspects most expected by customers: exterior design, interior and on-board technologies”, summarizes Alexandre Marian, partner at AlixPartners.

A priority given to “what customers really want”, where Western brands will also maintain a high level of demand in other aspects: driving behavior, acoustics and vibrations for example.

But, are the expectations of the European client now approaching those of the Chinese client? Not necessarily, but in Europe, it’s more the cost argument, and in particular the value for money in the entry-level and mid-range, that allows a model like the MG4 to be very successful.

Our comparison with the Renault Mégane e-Tech also insisted on this point: beyond the aspects of behavior on the road, it is difficult to have both French and Chinese equipment for the same price.

“Chinese brands have focused on integrating these modern elements into vehicles at attractive prices and at a faster pace than Western automakers, confirms Alexandre Marian. To be competitive, the latter need to invest in new technologies and adopt a challenging mindset. with an appetite for risk. of a start-up”.

European car battery factories It should also make it possible to cover the demand for electric vehicles in Europe from 2025. However, the cost of the raw materials necessary for their manufacture, which will always be imported, has remained subject to strong variations in recent years. Enough to force manufacturers to design different models, probably equipped with smaller batteries, to lower the final cost. Also to see if the implementation of a bond “made in Europe” will be able to contain this Chinese wave.

Source: BFM TV