From this Friday, November 1 and until March 31, the obligation to have mandatory winter equipment on the roads of 34 departments returns.

Education on this essential equipment

For this 2024/2025 season, no verbalization is planned, since from the first year of application of the “Mountain Law II” in France in 2021.

Road safety emphasizes the preventive aspect of this measure:

“The objective of this regulation is to reinforce the safety of users by reducing the specific risks associated with driving on snowy or icy roads.

It is also about avoiding blockage situations in mountainous areas, when unequipped vehicles are on the roads, unable to free themselves, immobilizing an entire axis of circulation.”points out the page dedicated to this regulation on its official website.

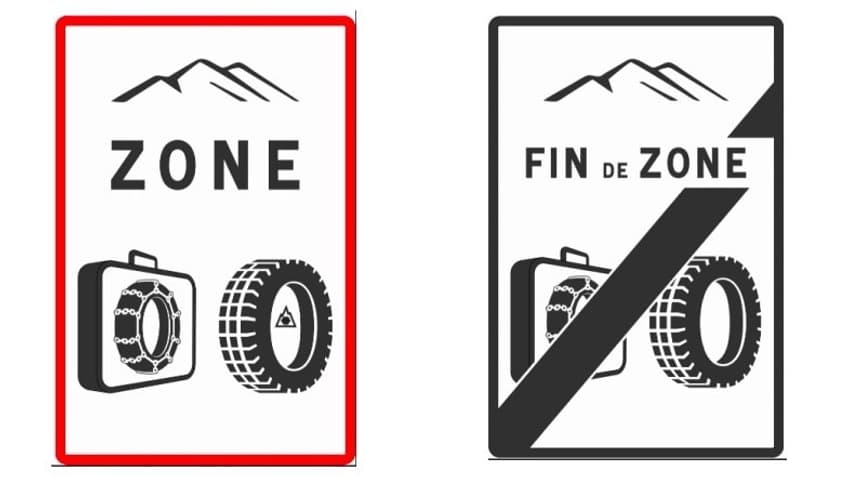

Signs inform you when entering and leaving an area requiring mandatory equipment (winter tires, four-season tires or removable equipment). “In case there is no snow or ice, removable devices (snow chains or socks) are stored on board the vehicle.”specifies road safety.

Despite this tolerance in terms of fines, the absence of winter equipment can be costly in the event of an accident.

Reduced compensation, penalty… a significant risk in the event of an accident?

It all depends on the conditions of the accident and whether, logically, the absence of suitable tires, or removable equipment, can be considered a triggering factor for the accident.

First example: in the event of an accident without a third party involved.

“To be compensated for your damages, you must have taken out a warranty. “accident damage”and compensation depends on what is established in this guarantee.”explains Christophe Dandois, co-founder of the neoinsurance company Leocare.

“As a general rule, and at Leocare, there is no warranty exclusion linked to non-compliance with the winter tire requirement. However, if the contract so provides, a deductible may be applied to the compensation. Penalties will also be awarded.”duck.

Another scenario: in the case of a “simple” break down on the corresponding roads and, always, without the equipment. “At Leocare there is also no exclusion linked to non-compliance with the winter tire requirement: access to vehicles and their repair can be more complex in winter conditions without the appropriate equipment.”explains Christophe Dandois.

As a precaution, it may be wise to check your contract to check that there is no warranty exclusion, but perhaps a possible penalty and deductible. If in doubt, contact your insurer who will also be able to advise you on purchasing suitable options.

things are getting complicated with a third party involved and without the guarantee “damage any accident”:

“You will not receive compensation unless you are a victim of the accident. On the other hand, if the absence of winter tires contributed to the accident, for example due to poorly controlled emergency braking, this may be considered a fault, which could limit, or even exclude, your compensation and affect your bonus.”underlines the general director of Leocare.

However, damage caused to a third party will be “systematically attended to if you are responsible”.

Christophe Dandois insists that these types of accidents are frequent in winter, “hence the importance of respecting this obligation”with “an impact on the coefficient whose bonus-malus can be significant”.

Prevention

However, another insurer, Axa, is quite reassuring and rules out a systematic exclusion of guarantees in the event of a lack of mandatory winter equipment.

“Today, insurance contracts do not provide for the exclusion of guarantees in the event of an accident for motorists insured with Axa France and who are not equipped in accordance with the recommendations of the Mountain Law.”the French insurer tells us.

“However, we invite all our policyholders before traveling during this winter period to pay special attention to the departments covered by the Mountain Law to equip their vehicles accordingly.”a spokesperson tells us.

Source: BFM TV