The French manufacturer of artificial hearts Carmat, in judicial administration, announced on Wednesday the suspension of its scholarship course since August 14, in order to examine an offer of resumption of the company scheduled for August 19.

Carmat, who opened a judicial administration procedure at the beginning of July, announced in a press release “the suspension of its Securities Market course since August 14, 2025 before the opening of the markets, ascending of the hearing scheduled for August 19, 2025”, where the court of economic affairs will examine an offer of recovery of Versailles.

A new press release will be published as soon as the result of the audience is known, depending on the company.

Liquidation risk

In the absence of money, the company created in 2008 and the entrance to the stock market in 2010, insists on “the fact that at this stage there is no certain offer that this offer is successful” and that it is “exposed to a risk of liquidation, even in the short term.”

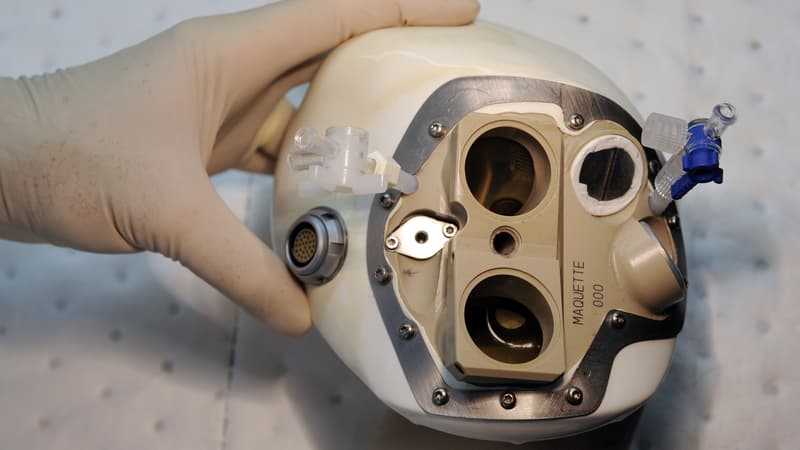

Heart Aeson designer, aimed at patients with severe heart failure pending a human heart available for a transplant, also recalls that “even in case of court validation, the shareholders and creditors of the company will probably incur a significant loss that can be related to all its investments or their debts.”

Carmat had failed to gather an additional effective “of at least 3.5 million euros” at the end of June, despite a donation campaign launched by companies and individuals, as well as procedures with the European Investment Bank (BEI) and public authorities.

At the end of December, two million of its own shares had bought a symbolic euro with the Airbus Group, one of its long -standing shareholders, to partially reimburse a loan hired with the BEI.

Source: BFM TV