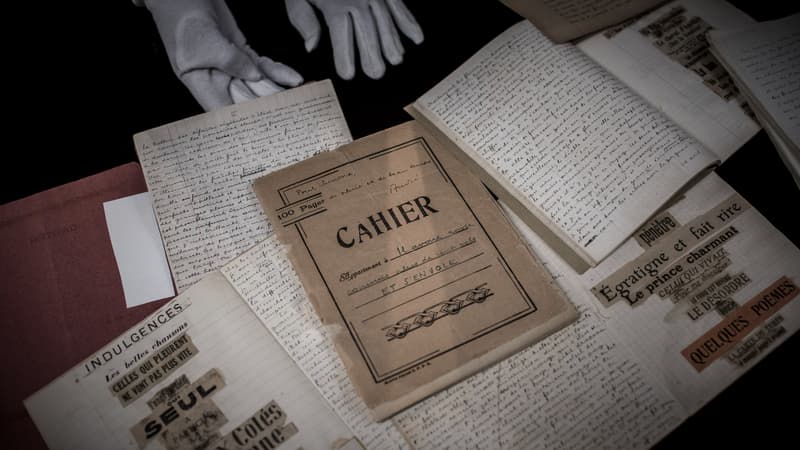

Thousands of savers, seduced by the promise of high yields thanks to the purchase of original Einstein, Proust or Romain Gary manuscripts, saw their money evaporate after the bankruptcy of the Aristophile company. Its founder and seven people are tried from Monday, September 8 in Paris on Monday, on Monday, during a trial that has to last approximately one month.

Police, technician, accountant or store advisor: they have invested 10,000, 40,000 or even 750,000 euros to become the owner, in its entirety or in joint possession, of old fashion cards and manuscripts with the announcement of an annual performance rate from 8% to 9%. Created in 2003, Aristophil would have caused more than 900 million euros to thousands of alleged victims, of which more than 4,500 formed civil parties.

A Ponzi pyramid?

The investment company in works of art, which celebrated, among other things, works by Louis-Ferdinand Céline or a letter written with four hands of Vincent van Gogh and Paul Gauguin, proposed to buy the works after five years with a greater prize.

Justice actually suspects a pyramid of Ponzi, a financial fraud based on the recruitment of new savers to remunerate the elderly. A scam famous for the matter of Madoff in the United States.

After giving birth to a speculative bubble, Aristophil made a resounding bankruptcy in 2016 that led to a gigantic auction process of the background. The letters and manuscripts were sold between 2017 and 2022 at much lower costs than the purchase price, being Aristophil’s suspicious of having inflated the price of manuscripts in a market niche qualified by several experts.

A letter from Napoleon Bonaparte to Joséphine, valued at 1.2 million per Aristophil, for example, was sold at an auction at 280,000 euros.

“Bags in an organized gang”

The purchase price of manuscripts when resale to savers had increased by an average of 147% and up to 317% for the “French Academy” collection, according to a DGCCRF survey.

Responsible for defending 400 victims as part of a collective procedure for the Association for Consumer Defense (ADC), the lawyer evokes this file as “the best financial fraud trial judged in France.”

At the head of Aristophil, Gérard Lhéritier, 77, appears for “scam in organized gangs and deceptive commercial practice.” His lawyer Benoît Verger intends to show that “the products (sold) were legal,” and added that Gérard Lhéritier, “tired but combative”, had never “met a customer.” The company was based on a network of 600 to 800 runners and used 65 employees.

Investments presented as “without risk”

Around 18,000 people had invested in the company. During the investigation, one of the savers explains that he was “seduced by the guarantee of a fantastic added value”, others say that his assembly management advisor had submitted these investment contracts such as “Eldorado”, “without risk.” The inverted sum sometimes represented “everything” of his savings.

And Aristophil’s clients were not experts and had been “approached by financial investment professionals and convinced to achieve profits.”

Aristophil “did not specify his calculation method or the selected works” and “The consumer could not verify the advanced elements.” Nor did it have “the ability to understand the risks that (CE) Market” have (CE).

Three Heritage Management Advisors, a law professor, who advised Gérard Lhéritier, a Parisian bookseller, a notary and a public accountant must also appear during the trial that must be held from September 8 to October 3.

Source: BFM TV