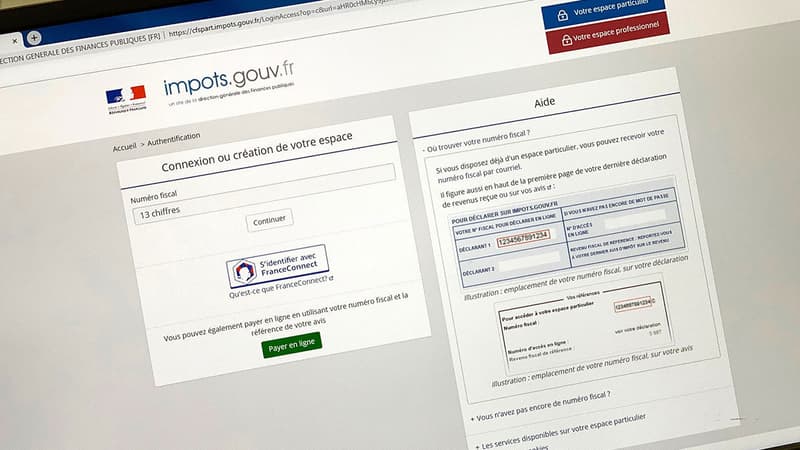

Launch of the tax return: Thursday the 2022 online income tax return service opens, used by the vast majority of French taxpayers.

Taxpayers have until May 25 to complete their pre-filled return on the impots.gouv.fr website if they are non-residents or live in an apartment numbered 1 to 19, until June 1 if they reside in an apartment numbered 20 to 54, and until June 8 for departments numbered from 55 onwards.

Among the main novelties of the 2023 tax refund campaign are the exemption of tips and the raising of the overtime exemption cap.

Specifically, tips received in 2022 by employees in contact with customers “are exempt from personal income tax and social contributions and contributions”, provided that the remuneration of the taxpayer in question does not exceed 1.6 Smic, details the General Directorate of Public Finance (DGFiP) in a brochure published on its website.

Raised scale due to inflation

Other novelties, “the annual ceiling for overtime or additional exempt hours is increased from 5,000 euros to 7,500 euros as of January 1, 2022” and “the ceiling of the deduction for childcare expenses is revalued from 2,300 euros under six years of age at 3,500 euros per child”, specifies the DGFiP.

To account for inflation, which returned in 2022 to levels not seen since the 1980s, the government raised the income tax scale by 5.4%.

Consequently, the income of taxpayers who have received less than 10,777 euros in 2022 will not be taxed and income between 10,777 and 27,478 euros will be taxed at 11%.

The tax rate increases to 30% for income between 27,478 and 78,570 euros, to 41% for income less than 168,994 euros and to 45% for income above this amount.

Reserved for users whose address is not connected to the Internet, the paper statement must be returned no later than May 22.

For this minority of taxpayers, mailing of pre-filled returns began on April 6 and will continue through April 25.

Source: BFM TV