With new car sales heading exclusively electric in 2035, this powertrain made further progress last year in Europe. 100% electric cars will represent 14.2% of the market in 2023 in the European Union, according to the latest figures published by ACEA this Thursday, January 18.

Electricity overtakes diesel

This represents 2.1 percentage points more compared to 2022. A timid progression, but in a market in strong growth, with a 13.9% jump in new car sales.

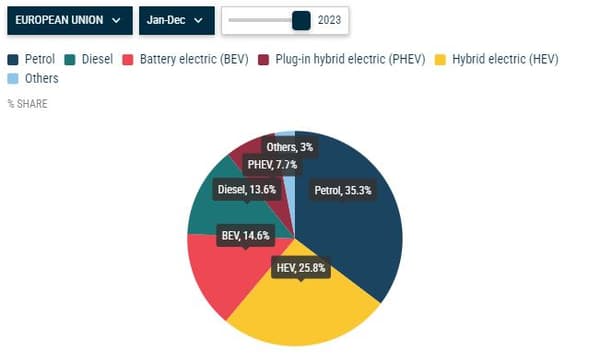

Significant data: sales of 100% electric vehicles have surpassed those of diesel vehicles for the first time in a year, falling to 13.6% market share. For its part, gasoline continues to be the main engine, with more than a third of sales (35.3%), ahead of non-rechargeable hybrids, with one in four sales (25.8%). Plug-in hybrids stand at 7.7%, 2.2 points less.

The Tesla Model Y overtakes the Dacia Sandero

If Volkswagen continues to be number one and has registered good progress compared to last year, it is Tesla that continues to climb at high speed in this context of transition to electric. The American brand sold 279,042 vehicles in the European Union, 89% more than in 2022.

An impressive increase, which takes the brand to volumes higher than those of Volvo or Seat.

Above all, the Tesla Model Y has established itself as the best-selling vehicle for all engines, a first for an electric car. In Europe as a whole (including the United Kingdom, Switzerland and Norway), the SUV would have exceeded 245,000 sales according to data compiled by Automotive News Europe.

Enough to overtake the Dacia Sandero, already second in 2022 ahead of the Peugeot 208. A strange leading duo, therefore, in 2023, with this polarization of the new market between a relatively high-end SUV (starting price currently at 43,000 euros in France excluding aid) ahead of the most affordable multipurpose city car (from 12,000 euros).

How successful will electricity be in 2024?

With an 18.2% market share for new electric vehicles in the European Union, Tesla takes the lion’s share of this ongoing transition, but faces increasing competition.

Firstly, the Volkswagen group, which recently positioned itself as the leader of the new electric market with 472,400 vehicles sold in 2023 in Europe. But a broader scope than the figures reported by the ACEA and that includes all the brands of the German group: Volkswagen, but therefore also Audi, Skoda, Cupra and Porsche.

On the Stellantis side, two brands in difficulty are betting heavily on electricity in 2024 to reactivate themselves. Firstly, Citroën, which fell another 2% last year in the EU, will launch its new ë-C3, one of the most affordable electric city cars on the market. At Fiat, which loses 2.7% in volumes in 2023, the same expectations remain with the future cousin of the ë-C3, the Panda converted to electric. Enough to complete the Italian brand’s offering after the launches of the 500e and 600e.

Finally, Renault will have its electric Scénic, to complete its new generation offer started with the Mégane E-Tech, enough to wait before the launch of the expected R5 at the end of the year.

As for Chinese manufacturers, MG (SAIC group) achieved a good performance in 2023 with its MG4, but it does not appear in the ACEA report. The world leader of the last quarter, BYD, has for its part begun its European adventure, but has already confirmed the upcoming construction of a factory in Hungary. Two new products could well revolutionize the market in 2024: the BYD Seagull and the MG3, two models that are expected for less than 20,000 euros.

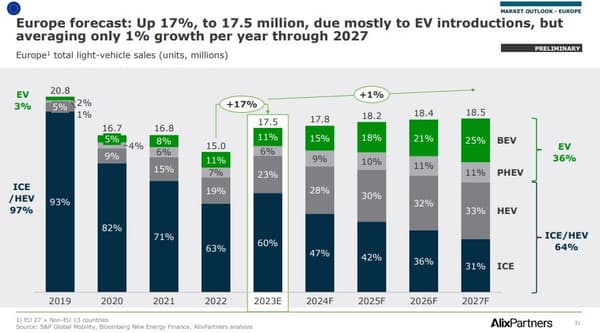

However, it is difficult to predict how the market will evolve this year in Europe. In its forecasts, but in a very broad scope (EU countries + 13 other countries, including the United Kingdom and Russia), the AlixPartners firm foresees a more limited increase in volumes in 2024, after the post-covid recovery and shortages. of components. , but with continued strong growth in the electrical sector.

In the longer term, the study expects a market share of 25% by 2027. See also how public aid will evolve to support sales during this period. The end of subsidies in Germany last December has already caused a sharp drop in purchases. It is quite logical, but we will see how Europe’s largest market behaves this year in this context.

In France, the end of the vagueness regarding the 2024 ecological bonus, whose implementation decree is still awaiting, should lead to a reduction in aid from 5,000 to 4,000 euros. Reduced aid, but a priori maintained, which should continue to support sales.

Source: BFM TV