Faced with rampant inflation in 2023, the French have visibly sought to reduce certain expenses. This is confirmed by the comparator Lesfurets, which notes a 17% increase in quotes to change car insurers last year, with more than one million requests.

More than 50% of budgets requested by those under 36 years of age

In this 2023 report, Lesfurets points out that it is the 26 to 35 year old category that most seeks to compare prices, with 29% of quote requests. They are ahead of young people aged 18 to 25, 27% of applications, and those aged 36 to 45, 20% of applications.

It is quite logical, since these age groups are also the ones that pay the most: 1,343 euros per year on average and all the formulas combined for offers formulated for young people from 18 to 25 years old, ahead of those from 26 to 35 years old with 867 euros per year and those between 36 and 45 years old at 695 euros per year. However, those between 46 and 55 years old are not far from this last rate, with 632 euros per year, ahead of those over 56 years old, with 565 euros per year.

If we look at the socio-professional categories, it is salaried employees who made the most requests in the comparator last year (60%), well ahead of the unemployed (10%), the self-employed (8%), students (7% ). ) and retirees (6%).

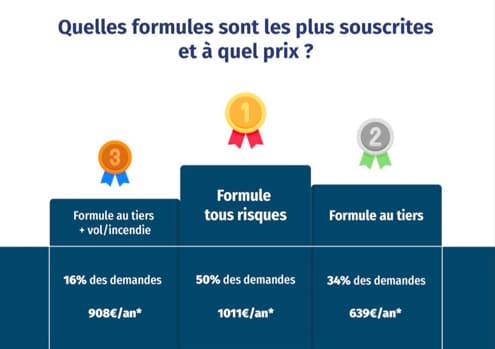

Half of all risk contracts

Among the different formulas, the “all risks” remains the most requested, with 50% of the quotes, followed by the third-party formula, with 34%, and finally this last formula complemented by theft and fire guarantees (often called “third+”).

Therefore, the price will depend on the level of coverage chosen, but also on other criteria such as those linked to the vehicle to be insured (make, model, year of entry into circulation, type of engine, use of the vehicle, etc.) and the profile of the vehicle. driver (his age, his driving history with the bonus-malus, profession, place of residence, etc.), reminds Lesfurets.

From 639 to 1,011 euros per year according to the formulas

In this 2023 evaluation, the comparator points out that “The all-risk formula was offered on average at 1,011 euros per year in Lesfurets (+5% compared to 2022), the third-party formula at 639 euros per year (+4% compared to 2022) and the theft/fire formula (third +) to 908 euros per year (-1% compared to 2022)”.

In terms of guarantees, 0 km road assistance was the most requested, ahead of the glass breakage guarantee and accident assistance.

1000 euros difference between “good and bad” drivers

The study also takes stock of the reduction-increase coefficient (CRM), better known as bonus-malus, which allows the risk associated with a driver to be assessed based on their background. With more than 1000 euros of difference between the “good” AND “bad” drivers, as you can see with these average rates based on this score.

With a CRM of 50 (the driver has not had any responsible or semi-responsible accident for more than 13 years), the average premium for all formulas combined was 530 euros per year in 2023. It rises to 831 euros per year for a CRM between 71 and 80, at 1,342 euros per year between 91 and 100 and at 1,657 euros for CRM of 125 and over.

Wealthy Bretons

It is in Brittany where car insurance is the cheapest, with a premium of 735 euros per year on average and 463 euros for those over 66 years of age (the category that pays the least for car insurance). On the contrary, it is in Provence Alpes Côte d’Azur where the premium is highest, 1,030 euros per year, almost 300 euros more than the Bretons, and 667 euros for those over 66 years of age, ahead of Ile-de-France (987 euros). and Auvergne-Rhône-Alpes (911 euros).

Source: BFM TV